avalara tax codes by state

If you have items that use P0000000 or U0000000 map them to an Avalara tax. ZIP codes often overlap or become subsets of other ZIP codes or represent no geographic region at all.

P0000000 and U0000000 are generic codes that are used when you have items that arent mapped to an Avalara tax code.

. Avalara Tax Changes 2022 Updated guide to the latest nexus laws industry compliance changes and more New. The Washington WA state sales tax rate is currently 65. Other local-level tax rates in the state of Washington are quite complex compared against local-level tax rates in other states.

Washington sales tax may also be levied at the citycountyschool. Depending on local municipalities the total tax rate can be as high as 104. ZIP codes arent stable.

For the most accurate sales tax rate use an exact street. These tax codes are taxed at the full rate. In any given year the USPS makes numerous boundary changes to ZIP code areas.

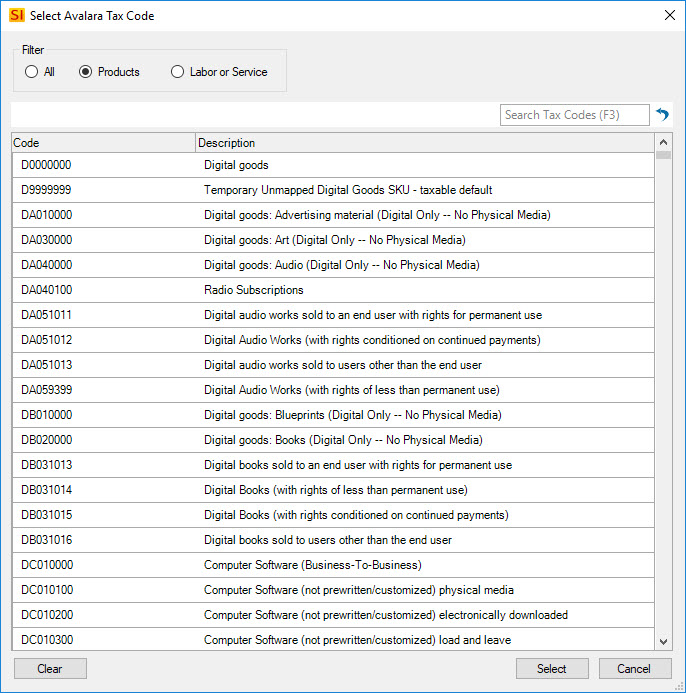

Map The Items You Sell To Avalara Tax Codes Avalara Help Center

Understanding The Avatax For Communications Tax Engine Avalara Help Center

Online Sales Tax Reporting And Filing Avalara Trustfile

Software Sales Tax Use Tax Avalara

Enablement Steps For Advanced Taxation Nimble Ams Help

Avalara Tax Integration D Tools